Journal entries are used whenever a financial transaction needs to be recorded in the books. In accounting, every event that changes the company’s finances must go through a journal entry first.

Here’s when you would use a journal entry:

Daily Business Transactions

Anytime money comes in or goes out:

Selling goods/services (record revenue)

Buying supplies, inventory, or equipment

Paying salaries, rent, utilities, or other expenses

Receiving payments from customers

Paying suppliers

Adjusting Entries (end of the month or year)

To record things not yet captured in cash:

Depreciation of equipment

Accrued expenses (e.g., salaries earned by staff but not yet paid)

Accrued income (e.g., interest earned but not received yet)

Prepaid expenses (e.g., rent paid in advance)

Correcting Errors

If something was recorded incorrectly, a journal entry is made to fix it.

Closing Entries (end of accounting period)

To reset temporary accounts (revenue and expenses) into retained earnings or capital account so the new period starts fresh.

To process a Journal transaction in PFIM click on General Ledger.

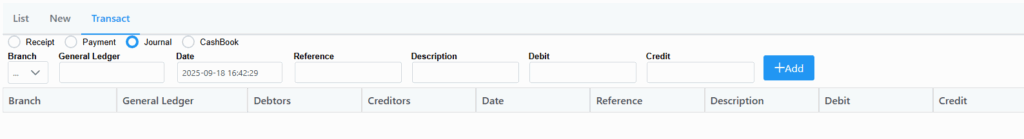

Click on Journal and the following window opens:

Enter the required details and click the ADD button.

This will add the transaction row to the grid.

Now do the opposite of the entry (ie if the first one is a debit the second one must be a credit)

The total for debit must be equal to the total for credit.

You can now submit the transactions and it will be recorded in the General ledger.