One of the key tools that aid in financial decision-making is age analysis, also known as aging analysis. This process provides a clear picture of outstanding receivables or payables by categorizing them based on the length of time an invoice has been outstanding. Whether for internal audits, credit risk management, or cash flow forecasting, age analysis plays a crucial role. Typically presented in the form of an aging report, the PFIM Age Analysis groups outstanding amounts into time buckets such as:

Current

30-Days

60-Days

90-Days

120-days

This allows organizations to track how long debts have been outstanding and identify potential issues in collections or payments.

Importance of Age Analysis:

Improves Cash Flow Management

Credit Risk Assessment

Informs Financial Reporting

Strengthens Supplier Relationships

Regulatory and Audit Compliance

PFIM offers the following types of Age Analysis

Accounts Receivable Aging

Accounts Payable Aging

To print the Debtors Age Analysis :

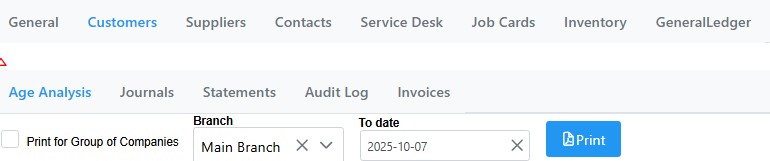

Go to REPORTING

Select CUSTOMERS

If it is for Group Of Companies, tick the marked box.

Select your Branch and Date

The select PRINT

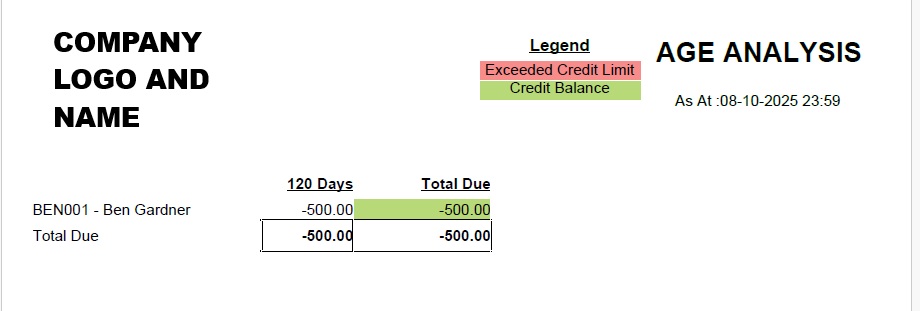

Sample of report: